How many of you teach your children about financial literacy and entrepreneurship? Both of those are definitely being added to Christian’s curriculum. I would much rather he learn the skills of saving and making money from a young age than have to learn the hard way as an adult. Money is not my sole concern in this world, but no one can deny that not having enough money OR not knowing how to manage the money that you do have can create a life that is full of stress and difficulty. I want him to learn how to save money, how to spend his money wisely, and how to take his skills and passions and turn them into an opportunity that can create/earn capital.

Not to mention the number of life skills and positive characteristics you have to develop in order to do any of these.

Money-Saving Skills include:

1. The willingness and ability to make sacrifices. Kids will learn that sometimes you have to sacrifice some things that you want in order to get the things that you need.

2. The ability to delay gratification. Sometimes we have to wait to get the things that we want.

3. The ability to prioritize. Kids will learn that some needs or goals should come ahead of others.

4. Analytical skills. When making any financial decision, we should be able to determine the return on investment. This skill can also be applied to other, non-financial situations as well.

5. An eye for detail. When you are committed to saving money it forces you to pay attention to things to the small details that many people would skim over or ignore, such as receipts and the fine print.

6. Being unafraid to ask questions or negotiate. Sometimes we can save money just by opening up our mouths.

7. Being able to say no and stick to it. This could go for telling yourself no or telling others.

8. Being able to set goals and stick to them. Kids should be able to set a goal for how much they want to save and stick to it.

Entrepreneurial Skills include:

1. Relationship building. Just about any business that you own will involve working with people. To have a successful business, you have to know how build relationships with those people so that you can build and maintain your customer base.

2. Being able to see the big picture. This is a skill that many people lack. They only think of short-term goals or what is right in front of them. The people who can see the big picture and set long-term goals are the ones who tend to succeed rather than giving up.

3. Commitment and work ethic. Anyone who hopes to have lasting success with a business has to be committed to their business. You can’t do it halfway and expect tremendous results. You have to go all in.

4. Work ethic. You also have to be willing to work hard and consistently to get results.

5. Patience. Any business owner can tell you that being able to ride it out during slow periods is critical.

5. Resilience. You have to be able to survive and bounce back from bad periods. Many businesses fail not just because they didn’t anticipate difficulties, but because they didn’t react well to those obstacles.

6. Resourcefulness. As a business owner (especially a money savvy one), you have to be able to make do with what you have and seek out ways to get what you don’t have.

7. A constant desire to grow. Often, when people achieve some big success, they become complacent rather than continuing to work hard. And that is when everything falls apart. A successful entrepreneur knows that you should never stop growing.

8. Organization and focus. Both of these go hand in hand when it comes to running a successful business.

9. Being independent. A successful entrepreneur can take charge and get things done on their own.

10. Being a team player. Although an entrepreneur should have a sense of independence, they should also know how to work with others to achieve goals. This includes learning how to network effectively. “No man is an island”.

11. Be coachable. Successful entrepreneurs realize that they don’t know everything. They are always learning, watching, and listening. They seek out mentors and people who know more than they do. They are open to suggestions on how they can improve. More importantly, they will actually implement what they learn.

12. Being proactive. Entrepreneurs know that success doesn’t come to you. You have to get out there and make it happen purposefully.

13. Being yourself and benefitting from it. Entrepreneurs are skilled at implementing what they learn from others while also carving out their own path.

I swear I have learned more LIFE LESSONS in the past 3 years that I have been an entrepreneur than I did during 14 years of primary school (including pre-k and kindergarten), 5 years of undergrad, and grad school. If I had learned these things as I child, I would be a powerhouse by now. Yes, knowing about history, language arts, mathematics, is important. I would never deny the benefits of being well versed in the arts. But we really need to realize that financial education is severely lacking in a world where your finances can make you or break you.

Because I would like to see more people learn about financial literacy for kids, I have done some research on resources you can use to teach your children. You will find a list of them below:

Kids’ Finance – Since 1999, this site has been dedicated to raising money smart kids and their families.

Money Math: Lessons for Life– This website offers a curriculum designed to teach middle school children about finances through real life examples.

The Centsables– Designed for kids ages 6-12, this kit was created to provide a turnkey, effortless way to bring financial literacy lessons into the classroom, with entertaining and engaging materials that keep students’ interest – and keep them asking questions.

Jump$tart Coalition– This site is designed to educate and prepare youth for life-long financial success.

Best Practices for Personal Financial Education Materials (PDF)

Money Sense for Kids– This book is a child’s guide to the power of investing.

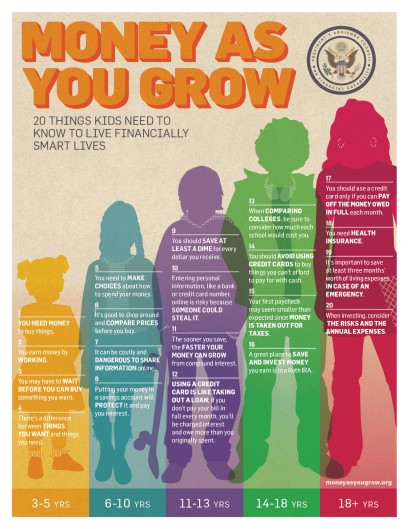

Money As You Grow– 20 things kids need to know to live financially smart lives starting at 3 years of age. Includes activities.

Prosperity4Kids– This site teaches kids how to give, invest, save, and spend.

Money Instructor Teaching kids money skills and personal finance. Topics include making money, saving money, counting money, making change, spending and saving, budgeting, checking, investing, and more money skills.

BizKid$– celebrates junior entrepreneurs and entrepreneur wannabees with plenty of chances to learn about and practice good business skills. The site is a companion to a new PBS series on finance designed especially for kids and features lots of info, blogs, games, and much more.

Three Jars-This is a site where children and parents can learn about money management, including charitable giving. (FREE if you sign up by JUNE 30th!!!)

Believe Financial Empowerment– Includes financial resources for children and teens.

Money Confident Kids– Resource for parents, educators, and kids about financial education.

What do you do to teach your children about making and managing money? Comment below!