This post has been sponsored by Arkansas 529. All thoughts and experiences are my own.

Y’all.

I’ve been doing this freelance writing thing since 2012 and it’s been one big learning experience.

I’ve learned more about my trade – of course. Taking courses on content writing, copywriting, the psychology of sales, etc.

I’ve made active efforts to learn more about marketing and sales outside of copywriting.

I’ve also had to do a LOT of mindset work centered around setting (and, more importantly, enforcing boundaries), time management, productivity, self-talk, and self-care. And it feels like those are just the tip of the iceberg.

But one thing that I’ve only recently come to realize is that I have a lot to learn about money. Not just as an entrepreneur, but as an adult.

That feels so embarrassing to admit!

Here I am, 35 years old, and just now realizing that my financial education has been severely lacking.

Sure, I know about paying bills, budgeting, saving money, and paying off debt. But I have to admit that I don’t implement all that I know (even though I should). I also don’t know all that I need to know about truly leveraging money in the best way possible. Which means I end up in financial situations that don’t feel all that great (read: they effing SUCK!).

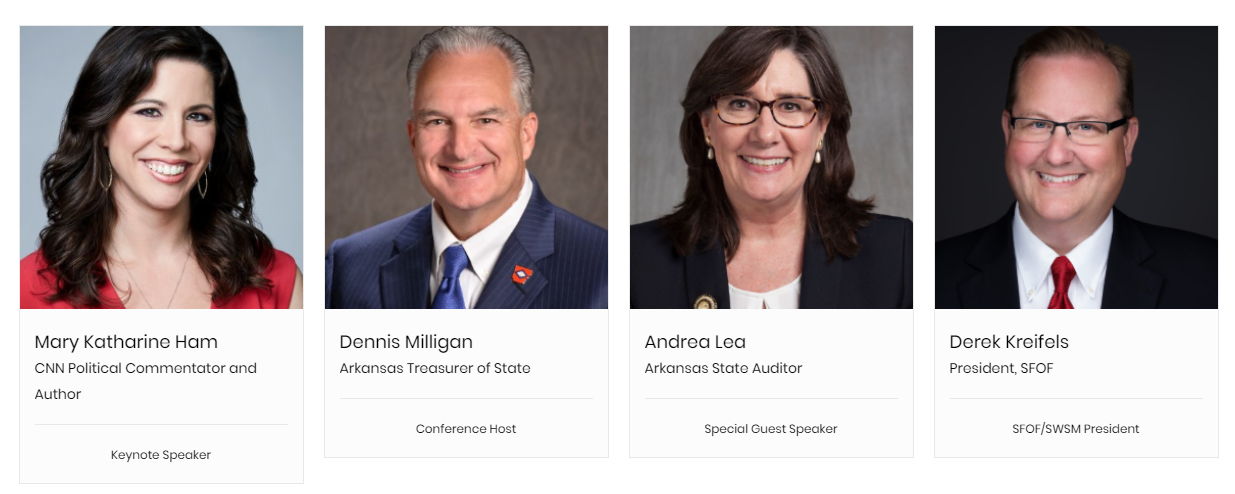

So, when I found out about the Smart Women Smart Money conference coming up on February 28th, I felt like it was created with someone like me in mind.

First of all, it’s FREE – my favorite price.

It’s also all about helping women from all backgrounds (regardless of age, marital status, socioeconomic status, parental status, etc) take control of our financial lives.

But the thing that really stood out to me was their core message that it’s never too early or too late to learn about finances.

So, if you’re like me and you’ve been feeling like you really need to take control of your finances in a major way, but don’t quite know how to get started, I hope you’ll register to attend the Smart Women Smart Money Arkansas conference.

It’s taking place on Friday, February 28th from 8am to 4:30pm at the Embassy Suites by Hilton in Little Rock (the one on Financial Center Parkway).

Registering is super easy! Just click on this link and fill out your info. Then, you get to choose 3 breakout sessions that you fill best meets your needs.

women of diverse ages and circumstances an opportunity to learn the necessary information to take control of their financial lives. The range of backgrounds includes young teen mothers to women who are well into retirement. The message of the conference is that it is never too late, or too early, to learn about finances. We provide this education through general sessions and smaller, educational breakout sessions. Attendees may choose topics that will lead them on a pathway to financial freedom and success.

Here’s a quick breakdown of the sessions, when they’re being held, and what they’re about. That way, you can decide now which ones you want to attend. You can also view this info here.

Breakout Session Info

Session 1: 11am-11:50am

Budgeting 101Your financial goals are important to you and it’s natural to sometimes wonder if you’re ever going to get there. To help build your financial confidence and keep on track during your journey, come learn about the fundamentals of creating a budget.

Saving for Education: The Ins and Outs of a 529 PlanTake a deep-dive to learn more about how a 529 college savings plan can help you or your loved one save for college, technical, vocational training, and other educational expenses. Hear from industry experts as well as representatives from the state’s 529 plan.

Avoiding Identity Theft and Preventing FraudIdentity thieves are real and looking for every opportunity to steal yours. We will talk about ways to be proactive and prevent falling victim to fraud. Learn about some common-sense steps you can take to protect yourself and your family.

Becoming a Proactive Planner: What is an Estate Plan, a Living Will, and Why Should I Have One

Have you thought about your assets and personal possessions and who would get them after you are gone? Sometimes life events force us to address life issues we would rather not. In this workshop, we talk about decisions you should make now to alleviate a burden later to your loved ones. We will cover factors you should consider when passing on your possessions, goals you want to accomplish, distribution options and consequences, and conflict resolution.

Session 2: 1pm-1:50pm

Know your credit score? Tips to improve your FICO score before making a major purchase

Understanding your credit score is essential to getting the best interest rate when purchasing a house or an automobile. In this session, learn what activities impact your credit score negatively and positively and how to avoid common mistakes right before making a major purchase.

Weathering the Storm: Navigating your long term financial plan no matter the forecast

Are your investments needing attention before a big storm? Whatever the global market forecast and frenzy – Examine your portfolio with a careful and disciplined approach to building, maintaining, and transitioning your wealth.

It is never easy to lose a parent — it’s even more difficult when you are named executor of the estate or power of attorney. Learn about the difference between the two and how to navigate issues regarding the death tax, life insurance, executing wills and estate plans.

Planning Ahead: What types of insurance make sense for you?

Insurance may be one of the most important purchases you’ll ever make. Find out how much you need, and how your family will benefit. You will also learn about different products and types of insurance including, life, long term care, and disability.

Session 3: 2pm-2:50pm

Defeating Debt: Freedom to live within your means

Learn about practical ways to pay off debt — the difference bad debt and good debt, and how to create a fund for those unexpected emergencies that we all face. We will also talk about the dangers of various payday loan programs.

Saving for the Future: It’s Never Too Early, It’s Never Too Late!

Finding creative ways now to build your assets up for later in life. Help understand the emotional attachment that can be just as powerful to save as it is to spend. Learn how to teach this valuable lesson to your children.

Investing 101 – Getting Started is Half the Battle

Learn about some of the best types of savings and investing tools. Learn about the power of compound interest as we discuss 401K’s, 403b’s, Roth IRA’s, and IRA’s.

From Idea to Action – How to Start a Business

What are some of the factors to consider when starting a small business? What is the difference between a C-Corp and an LLC? Where do I look for help in creating a business plan? Are there SBA loans or other financing options for my business?

As you can see, they have a variety of different topics that they cover, so you’re bound to find at least one workshop per session that you can learn something from. the hard part will probably be narrowing down the options to just the one you want to attend the most.

Personally, I am focused on making sure I make solid decisions that will protect my son – both now and in the future, so I would attend the workshops centered around proactive planning, weathering the storm, and defeating debt. But the workshops on budgeting and saving for the future are also appealing. Being honest, I wish I had a Time-Turner so that I could attend all of the session 3 workshops! And, of course, You know I’m a big fan of Arkansas 529 (see why here and here), so you know I recommend that workshop.

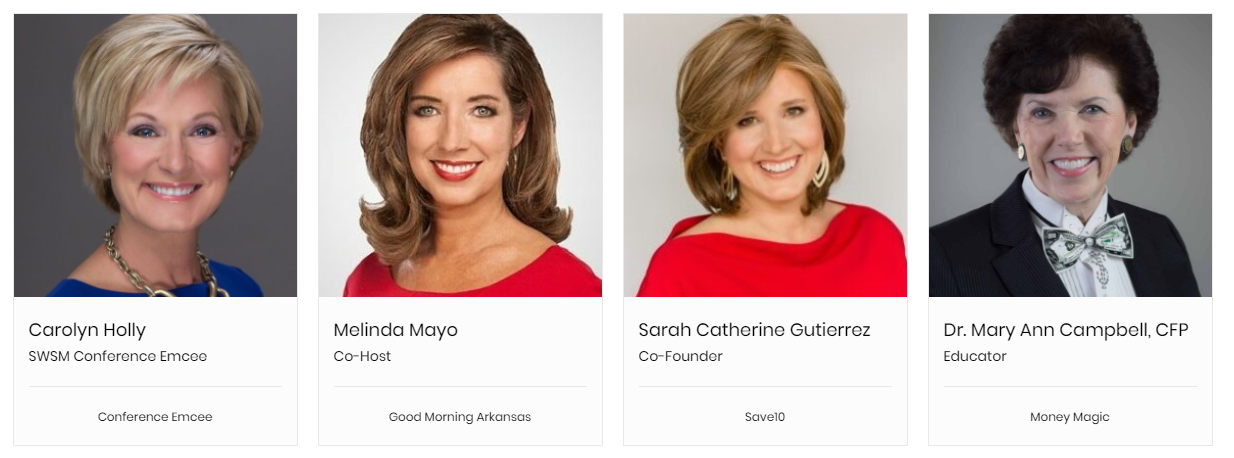

You may have also noticed that the breakout sessions don’t start until 11 even though the conference start time is 8am. There is a opening session plus two general sessions prior to that- plus a chance for you to visit vendor booths. Then, at noon, you’re invited to attend a complimentary lunch and lunch panel that will be moderated by Melinda Mayo from KATV 7. Check out the full schedule here.

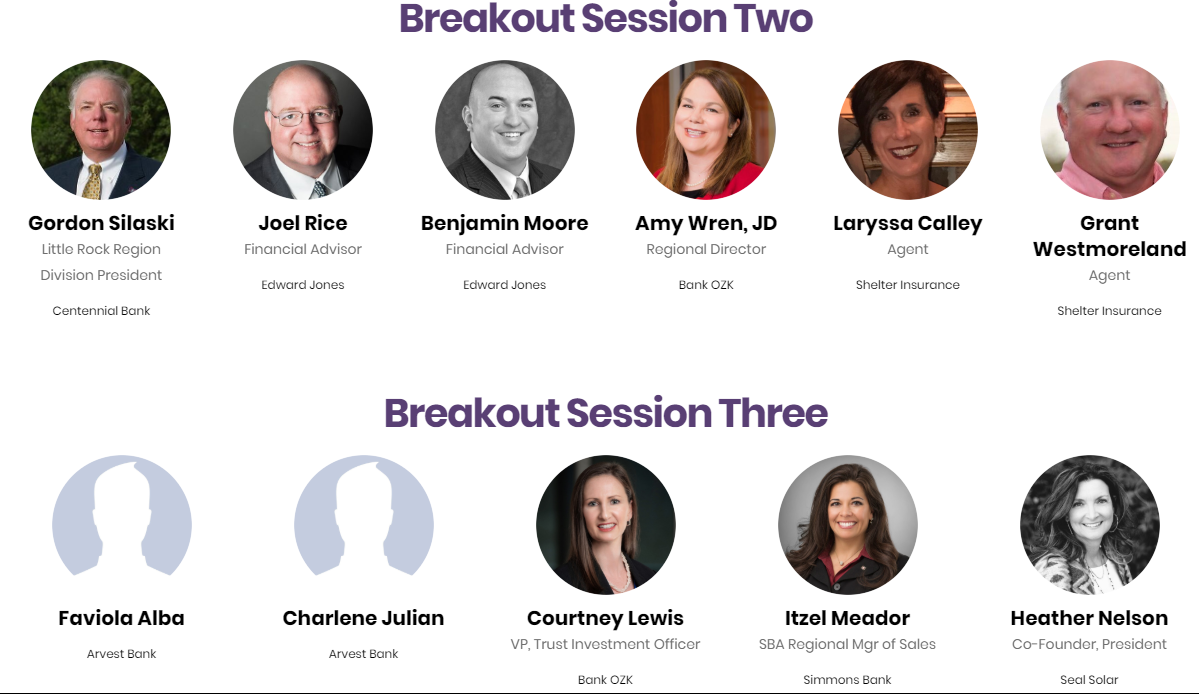

Curious about who will be speaking at the conference (I know I would be)? Check out the list of expert speakers here.

That’s about it! This event sounds like it could be really valuable for people who are ready to take charge of their finances and live lives that aren’t ruled by money woes and stress. If that’s you, take a few minutes to learn more about the Smart Women Smart Money Arkansas conference and get registered!